ABMax24

Active VIP Member

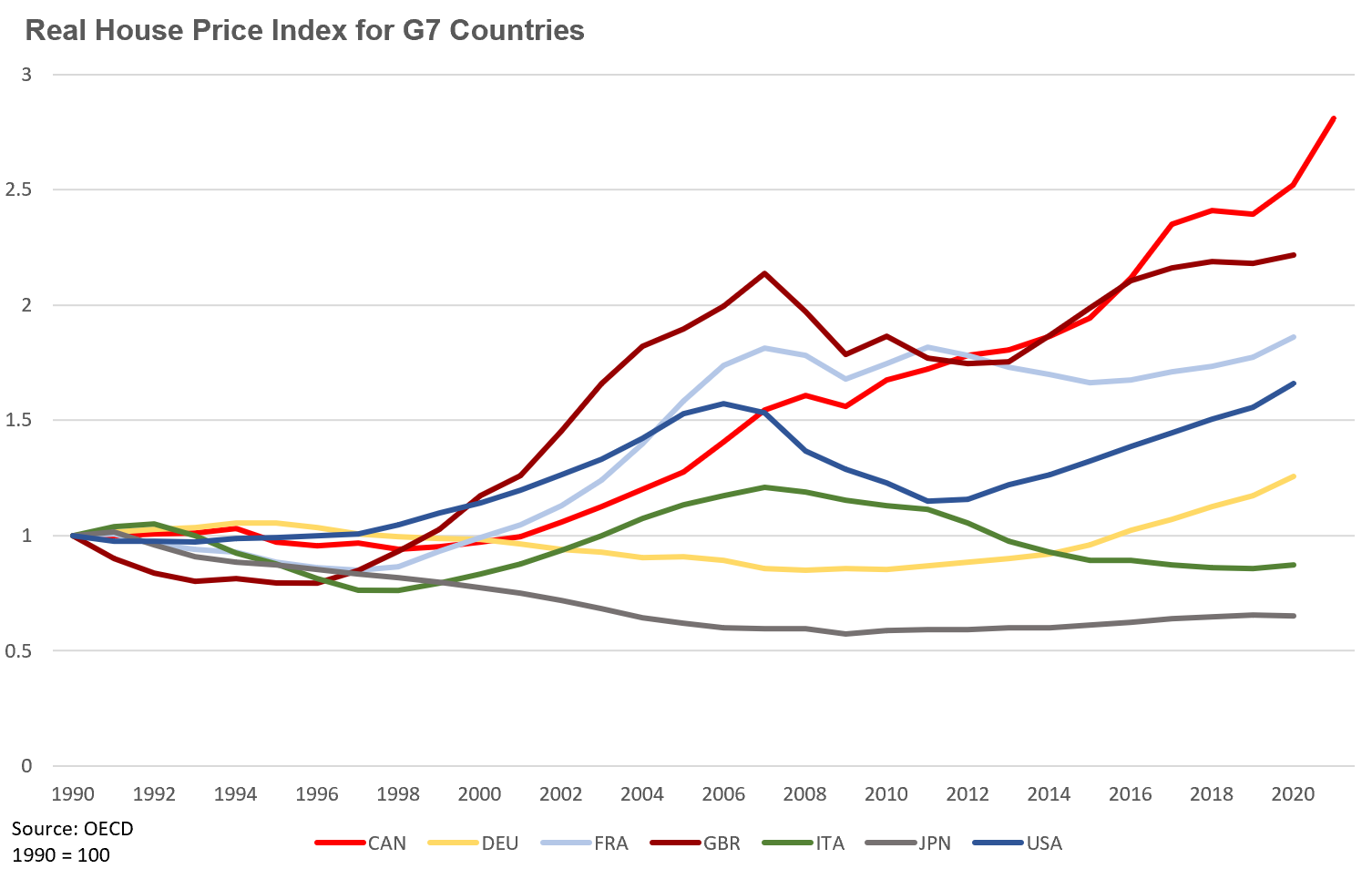

Big reversal in the housing market, probably more to come

wowa.ca

wowa.ca

Canadian Housing Market Report Jan. 23rd, 2023 | Interactive Map - WOWA.ca

Canada’s housing market ended off a turbulent year with prices at a 22-month low. Canada’s average home price has once again decreased on a monthly basis to $626,318 for December 2022.